Ministry of Commerce of the People’s Republic of China

Announcement

No. 35 of 2019

The Ministry of Commerce of the People's Republic of China (MOFCOM) received, on June 14, 2019, an application for anti-subsidy investigation formally submitted by Nanjing Nalcohol New Material Co., Ltd., Nanjing Rongxin Chemical Co., Ltd. and Zibo Nalcohol Chemical Co., Ltd. (hereinafter referred to as “the Applicants") on behalf of the domestic n-propanol industry. The Applicants requested MOFCOM to file an anti-subsidy investigation into imports of n-propanol originating in the United States. In accordance with the provision of Article 16 of the Anti-subsidy Regulations of the People's Republic of China, MOFCOM sent an invitation for talks on the anti-subsidy investigation to the US government on July 15, 2019 and held talks with the US government on July 26, 2019.

In accordance with the relevant provisions of the Anti-subsidy Regulations of the People's Republic of China, MOFCOM examined the qualification of the Applicants, the relevant situations of the product to be investigated, the relevant situations of the product of the same kind in China, the influence of the product to be investigated on the domestic industry, the relevant situations of the country in which the product to be investigated originates, etc..

According to the evidences provided by the Applicants and the preliminary examination of MOFCOM, the 2015, 2016, 2017 and 2018 annual n-propanol outputs of the Applicants respectively accounted for more than 50% of the 2015, 2016, 2017 and 2018 annual n-propanol outputs of China, which conforms to the provisions of Article 11 and Article 13 of the Anti-subsidy Regulations of the People's Republic of China on the application of a domestic industry for an anti-subsidy investigation.

The application has asserted that the product to be investigated has been subsidized by the US government and the US n-propanol industry (enterprises) may have benefited from 107 subsidy items. The application has also asserted that the quantity of the product to be investigated in the Chinese market has substantially increased, which has caused the domestic industry to reduce the prices of their product of the same kind and suffer substantial damage, and the causal relationship between the subsidy used to support the product to be investigated and the substantial damage that the domestic industry has suffered exists. After MOFCOM examined what the application asserted, it believed that the application included the contents and evidences that were necessary to filing an anti-subsidy investigation according the provisions of Article 14 and Article 15 of the Anti-subsidy Regulations of the People's Republic of China.

In accordance with the above-mentioned examination results and Article 16 of the Anti-subsidy Regulations of the People's Republic of China, MOFCOM has decided to file an anti-subsidy investigation into imports of n-propanol originating in the United States starting from July 29, 2019. The relevant matters are hereby announced as follows:

I. Filing of investigation and investigation period

As of the issue date of the Announcement, MOFCOM will file an anti-subsidy investigation into imports of n-propanol originating in the United States. The subsidy investigation period determined for the investigation is from January 1, 2018 to December 31, 2018, and the industrial damage investigation period is from January 1, 2015 to December 31, 2018.

II. Product under investigation and scope of investigation

Scope of investigation: imports of n-propanol originating in the United States

Chinese name of the product under investigation: 正丙醇. It is also called 1-丙醇 or 丙醇.

English name: n-Propanol, n-Propylalcohol, 1-Propanol, 1-Propylalcohol, Propan-1-ol, Ethylcarbinol or 1-Hydroxypropane. It is also called NPA for short.

Molecular formula: C3H8O

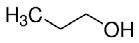

Chemical structural formula:

Physical and chemical properties: N-Propanol is a colorless liquid. It has an alcohol odor. Its molecular weight is 60.10, its melting point is -127°C and its boiling point is 96.5-98°C. Its relative density is 0.803-0.805 (20°C) and its flash point is 23°C. It dissolves in water and common organic solvents such as alcohol, ketone, aldehydes, ethers, glycols, and aromatic and aliphatic hydrocarbon.

Main applications: N-Propanol is directly used or esterified into n-propyl acetate, which is largely used in food packaging production and used as a printing ink solvent for food packages. N-propyl acetate is also an important component of the lithium cell electrolyte for new energy vehicles. As a prodrug, n-propanol is largely used in erythromycin production. It is an indispensable material of macrolides antibiotics. Meanwhile, it is also a starting material for the preparation of some drugs such as thiamine propyldisulfide and probenecid. As a chemical intermediate, n-propanol is used to synthesize glycol ethers, n-propylamine, n-propyl ester, bromopropane, etc.. As an excellent solvent, n-propanol is also widely applied in paint, oil paint, adhesive, cosmetics, plastics, bactericides, etc.. N-Propanol is also an important material in many fields such as food additives, feed adhesives, synthetic spices, detergents, plasticizers, lubricants, degreasing fluids, binding agents, preservatives and brake fluids.

The said product is listed under the tariff code of 29051210 in the Customs Import and Export Tariff of the People’s Republic of China.

III. Anti-subsidy investigation items

In the submitted application, the Applicants have asserted that the US government has subsidized the US n-propanol industry (enterprises) in 107 items. MOFCOM has decided to investigate the following subsidy items in the investigation after it completed its preliminary examination and considered the proposition offered by the US government in the talks held before the investigation was started:

(I) Items of the United States Federal Government

1. Expensing of Intangible Drilling Costs of the federal government

2. Percentage Depletion of Oil and Natural Gas Wells of the federal government

3. Two-year Amortization Period for Geological & Geophysical Expenditures of the federal government

4. Percentage Depletion for Hard Mineral Fossil Fuels of the federal government

5. Expensing of Exploration and Development Costs for Hard Mineral Fuels of the federal government

6. Deduction for Tertiary Injectant Expenses of the federal government

7. Exception to “Passive Loss” Limitation for Working Interests in Oil and Natural Gas Properties of the federal government

8. “Enhanced Oil Recovery” Credit of the federal government

9. “Marginal Wells” Credit of the federal government

10. Corporate Income Tax Exemption for Fossil Fuel Publicly Traded Partnerships of the federal government

11. Natural Gas Distribution Pipelines Treated as 15-year Property of the federal government

12. Temporary 50% Expensing for Equipment Used in the Refining of Liquid Fuels of the federal government

13. Research and development subsidies of the United States Department of Energy

14. EXIM loans

(II) Items of American local governments

15. Cook Inlet Platform Royalty Relief of Alaska

16. Small Cook Inlet Discoveries Royalty Relief of Alaska

17. Royalty Modification for Ooguruk Unit of Alaska

18. Taxable Per Barrel Credit of Alaska

19. Gas Storage Facility Credit of Alaska

20. LNG Storage Facility Credit of Alaska

21. Gas Exploration and Development Credit of Alaska

22. Gross Value Reduction of Alaska

23. Oil and Gas Industry Service Expenditures Credit of Alaska

24. Property-Tax Exemption for Intangible Drilling Expenses of Alaska

25. In-State Refinery Tax Credit of Alaska

26. Qualified Capital Expenditure Credit of Alaska

27. Development Credit for Small Producers and New Areas of Alaska

28. Alternative Credit for Exploration of Alaska

29. Percentage Depletion of Mineral and Other Resources of California

30. Severance-Tax Exemption for Stripper Wells of Colorado

31. Severance-Tax Oil and Gas Ad Valorem Credit of Colorado

32. “Impact Assistance” Credit of Colorado

33. Severance-Tax Reductions for Low-Volume Wells of Colorado

34. Severance-Tax Reductions for New Oil-Shale Facilities of Colorado

35. Severance-Tax Exemption for Low-Volume Oil-Shale Production of Colorado

36. Occupational-Privilege-Tax Exemption for Oil and Gas Workers of Colorado

37. Reduced Value for Certain Mineral Properties of Colorado

38. Sales-Tax Exemption for CO2 Used in Tertiary Recovery of Louisiana

39. Sales-Tax Exclusion for Installation of Board Roads in Oil-fields of Louisiana

40. Sales-Tax Exclusion on Drilling Rigs of Louisiana

41. Sales-Tax Exemption for Repairs and Materials Used on Drilling Rigs of Louisiana

42. Excess of Percentage over Cost Depletion of Louisiana

43. Natural Gas Severance Tax Suspension for Horizontal Wells of Louisiana

44. Natural Gas Severance Tax Suspension for Inactive Wells of Louisiana

45. Natural Gas Severance Tax Suspension for Deep Wells of Louisiana

46. Natural Gas Severance Tax Suspension for New Discovery Wells of Louisiana

47. Reduced Severance Tax on Incapable Oil Well Gas of Louisiana

48. Reduced Severance Tax on Incapable Gas Well Gas of Louisiana

49. Oil Deduction Severance Tax on Transportation Fees of Louisiana

50. Severance Tax Suspension on Oil from Horizontal Wells of Louisiana

51. Severance Tax Suspension on Oil from Inactive Wells of Louisiana

52. Severance Tax Suspension on Oil from Deep Wells of Louisiana

53. Severance Tax Suspension on Oil from New Discovery Wells of Louisiana

54. Severance Tax Suspension on Oil from Tertiary Recovery of Louisiana

55. Reduced Severance Tax Rate on Incapable Oil Wells of Louisiana

56. Reduced Severance Tax Rate on Oil from Stripper Wells of Louisiana

57. Severance Tax Exclusion on Flared or Vented Natural Gas of Louisiana

58. Severance Tax Exclusion for Natural Gas Used in Field Operations of Louisiana

59. Severance Tax Exclusion for Carbon Black Producers of Louisiana

60. Gas Gross Production Tax Exemptions + Oil Extraction Tax Exemptions of North Dakota

61. Reduced Tax Rate for Certain Wells outside the Bakken and Three Forks Region of North Dakota

62. Sales Tax Exemption for Oil of North Dakota

63. Sales Tax Exemption for CO2 Used for Enhanced Oil Recovery of North Dakota

64. Sales Tax Exemption for Natural Gas of North Dakota

65. Gross Production Tax Rebate for 3D Seismic Wells of Oklahoma

66. Gross Production Tax Rebate for Economically at Risk Wells of Oklahoma

67. Gross Production Tax Exemption for O&G Owned by Government of Oklahoma

68. Gas Marketing Deduction against Gross Production Tax of Oklahoma

69. Sales Tax Exemption for Electricity Used in Enhanced Oil Recovery of Oklahoma

70. Cost of Complying with Sulfur Regulations of Oklahoma

71. Full Expensing of Capital Investments in Qualified New Refinery Capacity of Oklahoma

72. Gross Production and Excise Tax Credits, Small Business and Rural Small Business Capital Companies of Oklahoma

73. Excess of Percentage over Cost Depletion of Oklahoma

74. Enhanced Oil Recovery Deduction of Oklahoma

75. Gross Production Tax Rebate for Horizontally Drilled Wells of Oklahoma

76. Gross Production Tax Rebate for Reestablished Production of Oklahoma

77. Gross Production Tax Rebate for Production Enhancement of Oklahoma

78. Gross Production Tax Rebate for Deep and Ultra Deep Wells of Oklahoma

79. Gross Production Tax Rebate for New Discovery Wells of Oklahoma

80. Realty-Transfer Tax Exemption for Resource Leases of Pennsylvania

81. Sales Tax Exemption for Oil & Gas Equipment of Texas

82. Severance Tax Exemptions for Crude Oil and Natural Gas of Texas

83. Exclusion of Low Volume Oil & Gas Wells of West Virginia

84. Coalbed Methane Exemption of West Virginia

85. Severance-Tax Reduction for Stripper Wells of Wyoming

86. Severance-Tax Reduction for Tertiary Recovery of Wyoming

87. 24-Month Severance-Tax Reduction of Wyoming

88. Severance-Tax Reduction for Workover Wells of Wyoming

89. Severance-Tax Reduction for Idle Wells of Wyoming

90. Severance-Tax Exemption for Flared Natural Gas of Wyoming

91. Sales-Tax Exemption for Transporting Drilling Rigs of Wyoming

92. Sales-Tax Exemption for Certain Well Services of Wyoming

93. Sales-Tax Exemption for CO2 Used in Tertiary Production of Wyoming

94. Severance-Tax Credit for Certain R&D Projects of Wyoming

95. Texas Economic Development Act

96. “Texas Enterprise Fund”

97. M E G A Job Creation Tax Credits

98. Michigan “Renaissance Zone” Act

99. Brownfield Redevelopment Tax Credits of Michigan

100. Industrial Facilities Exemption of Michigan – P.A. 198

101. “Centers of Energy Excellence” Program of Michigan

102. Refundable Photovoltaic Manufacturing Tax Credit of Michigan

103. Payment in Lieu of Tax of Tennessee, PILOT

104. FastTrack Economic Development Fund Grants of Tennessee

105. “Commonwealth Development Opportunity Fund” of Virginia

106. Virginia Investment Partnership Grant Program

107. Industrial Tax Exemption Program of Louisiana

IV. Registration for the investigation

The stakeholders and the governments of the interested countries may register with the Trade Remedy and Investigation Bureau of the Ministry of Commerce for this anti-subsidy investigation within 20 days after the issue date of the Announcement. The stakeholders and the governments of the interested countries participating in the investigation are required to provide their basic identity information based on the Reference Format of the Registration for the Investigation and the explanatory materials including the quantities and amounts of the products investigated in the case of exports to China or the import case, the quantities and amounts of the products of the same kind produced and sold and the other relevant situations. The Reference Format of the Registration for the Investigation can be downloaded from the relevant website (URL attached below, similarly hereinafter).

The stakeholders in the Announcement refer to the individuals and organizations defined in Article 19 of the Anti-subsidy Regulations of the People's Republic of China.

V. Public information

The stakeholders and the governments of the interested countries may download public information from the related websites, or go to the MOFCOM Trade Remedy Public Information Office (Tel: 0086-10-65197878) to search, read, transcribe and copy the non-confidential version of the application submitted by the Applicants. In the process of investigation, the stakeholders and the governments of the interested countries can refer to public information about the case through the relevant websites, or search, read, transcribe and copy the public information about the case in the MOFCOM Trade Remedy Public Information Office.

VI. Comments

If any stakeholder or the government of any interested country needs to comment on the product scope under investigation, the qualification of the Applicants, the investigated countries and other related questions, the stakeholder or government may submit its comments in written form to the Trade Remedy and Investigation Bureau of the Ministry of Commerce within 20 days after the issue date of the Announcement.

VII. Investigation methods

In accordance with Article 20 of the Anti-subsidy Regulations of the People's Republic of China, MOFCOM may get information on the related situations from the stakeholders and the governments of the interested countries by conducting questionnaire surveys, sampling, hearing, on-site verification, etc. and carry out the investigation.

In order to obtain the information required for the investigation of this case, MOFCOM usually issues questionnaires to the foreign exporters or manufacturers, domestic manufacturers and domestic importers involved in the case and the governments of the interested countries listed in the application within 10 working days from the deadline for registering for the investigation as prescribed herein. The stakeholders and the governments of the interested countries that have registered for the investigation can download the questionnaires from the relevant websites.

The information that the Questionnaire for Foreign Exporters or Manufacturers on the N-Propanol Anti-subsidy Case aims to obtain includes the corporate structures, operation, affiliated companies, production costs, sales, etc. and the detailed information on each specific subsidy item to be investigated, etc.. The information that the Questionnaire for Domestic Manufacturers on the N-Propanol Anti-subsidy Case aims to obtain includes the basic corporate conditions, the situations of the domestic products of the same kind, the business operation information, the financial information and the other relevant information. The information that the Questionnaire for Domestic Importers on the N-Propanol Anti-subsidy Case aims to obtain includes the basic corporate conditions, the investigated product trade and the other relevant information. The information that the Questionnaire for the Governments on the N-Propanol Anti-subsidy Case aims to obtain includes the relevant information on the products to be investigated, the industrial situations, the management structures, the policies, etc. and the detailed information on each specific subsidy item to be investigated, etc..

The stakeholders and the governments of the interested countries who have not registered for the investigation can directly download the above-mentioned questionnaires from the relevant websites or go to the Trade Remedy and Investigation Bureau of the Ministry of Commerce and ask for the above-mentioned questionnaires. They shall complete the questionnaires according to the requirements.

All the companies and the governments of the interested countries shall submit their complete and accurate answer sheets within the specified time period. The answer sheets shall include all the information requested in the questionnaires.

VIII. Submission and processing of confidential information

If it is necessary to keep confidential the information submitted to the Ministry of Commerce by a stakeholder or the government of an interested country, the said stakeholder or government may make a request to the Ministry of Commerce for confidential treatment of relevant information and the stakeholder shall give reasons for it. If the Ministry of Commerce agrees to the said request, the stakeholder applying for confidential treatment shall provide a non-confidential summary of the said confidential information. The non-confidential summary shall include full and meaningful information, so that the other stakeholders can reasonably understand the confidential information. If the non-confidential summary cannot be provided, the stakeholder or government applying for confidential treatment shall give reasons for it. If a stakeholder or the government of an interested country does not state that the information submitted by the stakeholder should be kept confidential, the Ministry of Commerce will deem the said information as public information.

IX. Consequences of non-cooperation

According to Article 21 of the Anti-subsidy Regulations of the People’s Republic of China, when MOFCOM makes an investigation, the stakeholders and the governments of the interested countries shall faithfully reflect the situations and provide the relevant materials. If a stakeholder or the government of an interested country fails to faithfully reflect the situations or provide necessary information, or fails to provide necessary information within a reasonable time, or seriously impedes an investigation in any other way, MOFCOM may give a ruling according to available facts and attainable best information.

X. Investigation period

The investigation starts from July 29, 2019 and generally ends before July 29, 2020. In some special circumstance, the deadline may be extended to January 29, 2021.

XI. Contact of MOFCOM

Address: No. 2 Dong Chang'an Avenue, Beijing, China

Postcode: 100731

Trade Remedy and Investigation Bureau of the Ministry of Commerce

Tel: 0086-10-65198417 and 0086-10-85093415

Fax: 0086-10-65198415

Relevant websites: the Sub-website of the Trade Remedy and Investigation Bureau of the Ministry of Commerce (http://trb.bjdzzs.com)

China Trade Remedies Information Website (http://www.cacs.bjdzzs.com)

Ministry of Commerce of the People’s Republic of China

July 29, 2019

MINISTRY OF COMMERCE PEOPLE'S REPUBLIC OF CHINA

MINISTRY OF COMMERCE PEOPLE'S REPUBLIC OF CHINA

MINISTRY OF COMMERCE

MINISTRY OF COMMERCE